Provenir Inc

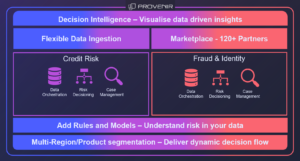

Provenir is an award-winning real time decisioning and orchestration platform using AI to drive actionable outcomes. A single hub that allows you to manage all your risk, orchestrate best of breed data providers and build strategies across the customer lifecycle from credit risk & fraud onboarding, customer management and collections.

Fraud Solution Profile

The Provenir platform offers a comprehensive solution for managing application fraud, empowering you to streamline your processes, improve decision accuracy, and enhance operational efficiency. Typical risks we see are impersonation fraud, identity theft and synthetic ID along with the complexity of detecting for mule accounts.

Here’s a breakdown of its key features:

Flexible data orchestration: The platform seamlessly ingests and integrates data from various sources, including credit bureaus, customer relationship management (CRM) systems, and public databases. This holistic view allows for a more comprehensive assessment of applicant risk.

Best-in-class pre-built integrations: The platform integrates with a wide range of pre-built connectors, eliminating the need for complex custom development. This ensures a faster time to implementation and reduces integration costs. Examples of effective sources are as followed:

Complex rules decisioning flows: The platform goes beyond simple rule-based checks. It allows you to create sophisticated decision trees that take into account multiple factors and data points. This enables you to tailor your fraud detection strategy to your specific risk profile.

Ability to upload or build your own fraud models: In addition to the platform’s built-in fraud detection capabilities, you can also incorporate your own custom machine learning models. This gives you the flexibility to leverage your unique data and expertise to further refine your fraud detection efforts.

Domain expertise for Analytics: Our team of industry experts in Application Fraud, together with our data science team can then provide consultancy and advisory support around AI and Machine Learning ensuring you design and build the best strategies for the threats and risks the business faces.

Empower end users through case management tools: The platform provides a centralised case management tool that equips agents with all the necessary information and resources to make informed decisions. This includes applicant data, risk scores, and investigation notes. Agents can also collaborate and communicate seamlessly within the platform.

Driving Data Driven Decisions for Optimisation: Using Decision Intelligence, you can then visualise all the data and understand how strategies are performing and where you might want to tune and optimize the system.

Unified credit risk strategy: The platform can also integrate with your credit risk strategy, providing a holistic view of applicant risk. This allows you to make more informed decisions about loan approvals and credit limits.

Telia

Jeitto

SoFi

MTN

Varo

Ecommerce, Financial Services, Insurance, Telecom

Orchestration Hubs

New Account Fraud, Synthetic Identity Fraud

Behavioral Biometrics, Biometrics, Machine Learning, Multi-Factor Authentication, Rules Engine