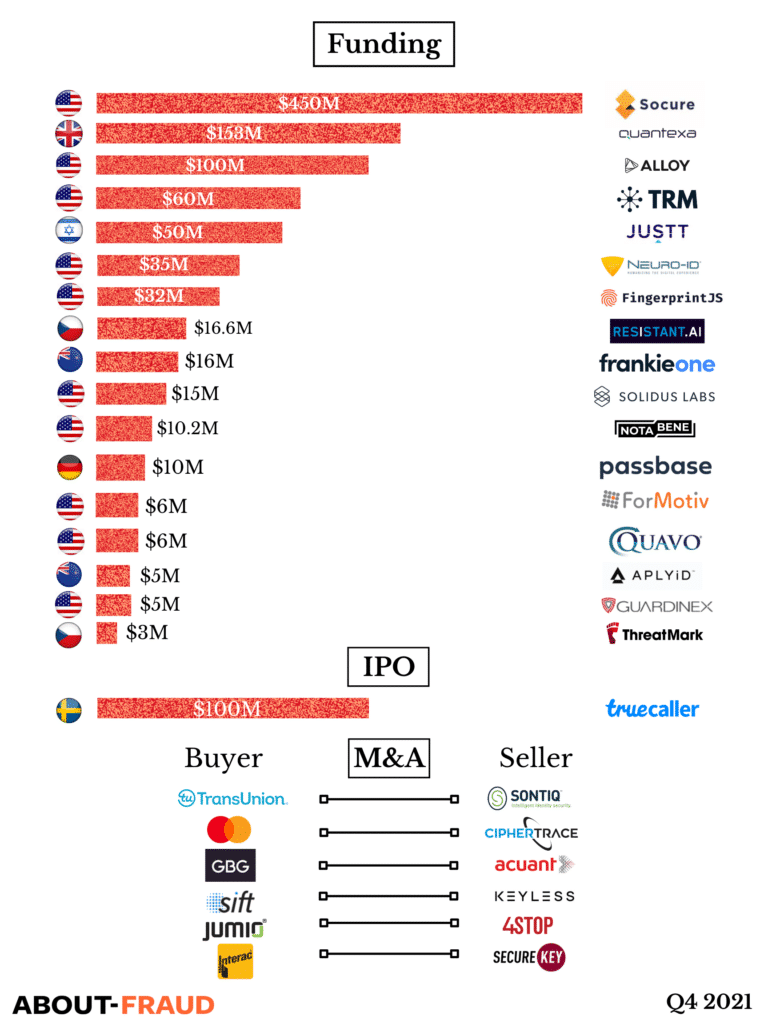

Investment, Acquisitions & IPOs – Q4 2021

We wrote articles earlier this year detailing the huge investment and acquisitions within the identity, fraud and AML space. Q4 of 2021 is no different, as the space stays red hot. Have a look at the latest and greatest and we’ll keep you updates as we move into 2022!

Neuro-ID

Neuro-ID secures $35M in Series B Funding Led by Canapi Ventures to further capitalize on expanding behavioral analytics market opportunity.

Founded in 2014, by Joe Valacich and Jeff Jenkins, Neuro-ID delivers real-time behavioral analytics solutions that combat online fraud, increase conversion rates, and improve customer experiences.

FingerprintJS

FingerprintJS raised $32 million in series B funding led by Craft Ventures with participation from Nexus Venture Partners and Uncorrelated Ventures.

Founded in 2019 by Pinto and Valentin Vasilyev, FingerprintJS offers a “fingerprinting” service engineered to prevent fraud, spam, and account takeovers by combining hundreds of signals inside a web browser to generate an identifier that can be used to detect unusual behavior

TransUnion

TransUnion has signed a definitive agreement to acquire Sontiq, a leader in digital identity protection and security, for $638 million. The acquisition of Sontiq will offer a comprehensive set of omnichannel solutions to make trust possible for consumers and businesses.

Alloy

Alloy has raised $100 million in funding. Founded in 2015, Alloy was built to help connect banks and fintech companies to more sources of KYC, AML and other compliance data.

APLYiD

APLYiD, a New Zealand based firm, has raised NZ$7 million (US$5 million) in investment, and plans to allocate the funds to supporting its strategic growth plans, which include entry into the Australian, UK and Asian markets.

Threatmark

Threatmark has closed a $3 million funding round led by Springtide Ventures.

Threatmark provides its behavioral biometrics, real-time transaction monitoring and analysis, and threat detection technologies to financial institutions and other major online businesses impacted by digital fraud.

Mastercard

Mastercard has acquired cryptocurrency intelligence company CipherTrace to extend its capabilities into the field of digital assets.

Mastercard said the deal will allow it to offer a service that combines artificial intelligence, cyber and blockchain capabilities to provide businesses with greater transparency to help identify and understand their risks and manage regulatory and compliance obligations.

Resistant AI

Resistant AI, a startup developing automation technologies that respond to vulnerabilities in financial services, has raised $16.6 million in a series A funding round from GV with participation from Index Ventures, Credo Ventures, and Seedcamp.

The Czech Republic-based company will use the funding to build out Resistant AI’s product, engineering, and sales operations teams beyond their current offices.

Interac

Interac Corp., a leading payments network and digital ID provider, has acquired the exclusive rights to SecureKey Technologies Inc, a leading digital ID and authentication provider that works with governments, financial institutions, and businesses to simplify consumer access to online services and applications.

Truecaller

Truecaller seeks to raise $116 million. in an Initial Public Offering (IPO) The Swedish mobile phone directory, caller id and spam blocking service provider. Truecaller, a Swedish based company, offers services that allow users to avoid spam calls by identifying the callers, and also filters similar texts.

Quantexa

Quantexa raised $153 million in series D funding. Quantexa’s algorithms are able to find hidden patterns in banking and other data to help prevent crimes ranging from money laundering, sex trafficking, child exploitation and organ trafficking.

ForMotiv

ForMotiv, the leader in digital behavioral data capture and predictive analytics solutions used by Fortune 500 insurance carriers and financial institutions carriers globally, has raised $6 million in funding led by Vestigo Ventures with participation from Plug & Play Ventures, DreamIt Ventures, and other investors.

Socure

Socure, a company that uses AI and machine learning to verify identities, raised $450 million in funding for its Series E round which was led by Accel and T. Rowe Price. Socure is the leading platform for digital identity verification and trust.

GBG

GBG, the experts in digital location, identity and identity fraud software, has acquired Acuant, a leading identity verification and KYC/AML compliance provider, for $736 million.

Sift

Sift has acquired Keyless, a pioneer in passwordless and multi-factor authentication.This acquisition of Keyless will hopefully unlock a passwordless future that is safe, secure, and free of account takeover fraud. With Sift and Keyless together, businesses and their users can be protected from account takeover attacks while preserving privacy and reducing friction.

Guardinex

Guardinex has raised $5 million in Series A funding. Guardinex’s cloud-based platform connects to client applications and identifies fraud risk in real time using AI and behavior models that predict fraudster tactics.

Justt.AI

Justt, a Tel Aviv-based chargeback mitigation startup, has raised $50 million in Series B funding. The company plans to use its new capital to invest more into product development, sales and marketing, including expanding its sales and marketing operations overseas to the U.S. and Europe.

FrankieOne

FrankieOne has raised $16 million in Series A funding and plans to use it to provide fintechs with ID and fraud management as a service and grow its footprint internationally after seeing strong demand in the market.

The company harnesses data sources to verify automatically people’s identities when onboarding, and then monitor subsequent activity for fraudulent behavior.

Solidus Labs

Solidus Labs, which has surveillance and risk-monitoring software that can detect manipulation across cryptocurrency trading platforms, has raised $15 million in funding.

Notabene

Notabene has raised $10.2 million in a Series A funding. The company plans to use the money from the funding round to scale its technology to support an influx of new customers.

Notabene helps crypto businesses grow faster by removing regulatory complexity and adding transparency and ease to their transaction flows.

Passbase

Digital identity startup Passbase, which offers SDKs for running remote identity checks, has raised $10 million in Series A funding as it dials up attention on crypto compliance, touting tools to help fintechs with rapidly evolving regulatory requirements.

Jumio

Jumio, the leading provider of AI-powered end-to-end identity orchestration, eKYC and AML solutions, has acquired current strategic partner 4Stop, the leading data marketplace and orchestration hub for KYB, KYC, compliance and fraud prevention.

The addition of 4Stop’s data sources to the Jumio KYX Platform realizes Jumio’s strategic vision of redefining the end-to-end identity industry.

TRM Labs

TRM Labs has raised $60 million in Series B funding. The company works with financial institutions, cryptocurrency-focused companies, and public sector agencies on issues of fraud and financial crime. Its toolkit includes services for monitoring and screening cryptocurrency wallets and transactions, to help companies manage risk and comply with regulations.

Quavo

Quavo has raised $6 Million in Series A financing round led by FINTOP Capital. Quavo is a leading provider of cloud-based dispute management solutions for financial institutions and FinTech organizations.

| Tagged with: |

| Posted in: | AF Education |