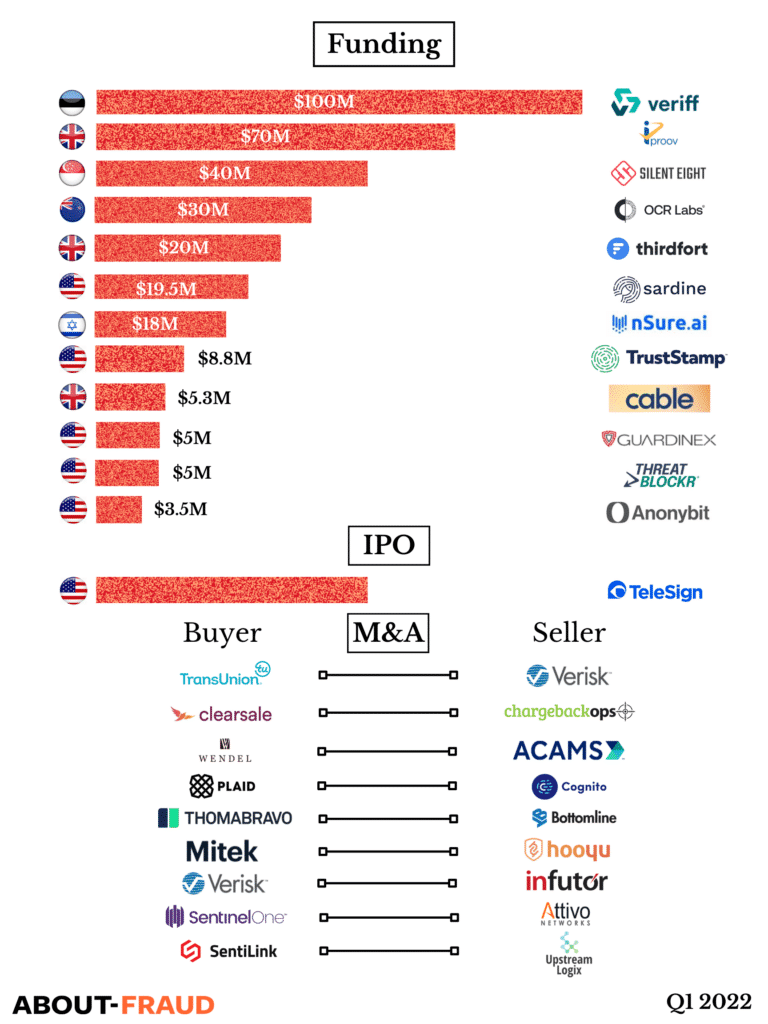

Investment, Acquisitions & IPOs – Q1 2022

We are already through the 1st quarter of 2022, so it is time to report and let you know about the investment and acquisition developments within the fraud prevention space so far this year. Have a read of this article to learn more about the companies, funding raised and acquisitions.

TeleSign, a Leader in Digital Identity and CPaaS Software Solutions for Global Enterprises, intends to go Public at an Enterprise Value of $1.3 Billion via a Business Combination with North Atlantic Acquisition Corporation.

Total capital raised to be up to approximately $487 million including proceeds from North Atlantic Acquisition Corporation and a $107.5 million PIPE.

Bottomline Technologies, a leading provider of financial technology that makes complex business payments simple, smart and secure, announced that it is being acquired by Thoma Bravo, a leading software investment firm, in an all-cash transaction that values Bottomline at approximately $2.6 billion. Upon completion of the transaction, Bottomline will become a privately held company.

iProov

iProov, a Biometric authentication company, has raised $70 million in a round of funding from Silicon Valley growth fund Sumeru Equity Partners, as demand for online identity verification soars.

Trust Stamp

Trust Stamp, a global provider of AI-powered trust and identity services used across multiple sectors, has raised $8.84M in funding through a combination of a public and private fundraise and warrant executions.

Cognito

Plaid has acquired identity verification and compliance platform Cognito in a deal reported to be worth around $250 million.

Cognito’s technology is used by hundreds of digital finance firms – including Plaid customers such as Affirm, Brex, Current, Republic and Wyre – to quickly, simply and safely verify users while ensuring KYC and AML compliance.

Anonybit

Anonybit, the pioneer in decentralized biometrics, has raised $3.5 million in a funding round. The financing was led by San Francisco-based Switch Ventures. Other participants included NextGen Venture Partners, Industry Ventures, Preceptor Capital, and several strategic angel investors.

The funding will enable Anonybit to accelerate its work with embedded partners and enterprises in support of the growing need for greater data protection and enhanced digital security, a direct response to the growing threat landscape.

ACAMS

Wendel, a French investment company, has agreed to buy ACAMS, a company which provides training and certifications for anti-money laundering and financial crime prevention, for around $500 million.

Veriff

Estonian identity verification startup Veriff has just raised $100m in Series C funding. The investment round was co-led by Tiger Global and Alkeon, with participation from existing investors IVP and Accel. Veriff says that the company will use the fresh funding for R&D and hiring.

Clearsale has acquired ChargebackOps. As a result of this acquisition, both ChargebackOps and ClearSale clients will benefit from enhanced end-to-end chargeback services – helping them address an ever more challenging ecommerce fraud landscape. Both organizations will continue to operate business as usual without any disruption to existing relationships.

Sardine

Sardine, the fraud and compliance platform for fintechs, has raised $19.5 million in Series A funding from Andreessen Horowitz, NYCA, and Experian Ventures to enable companies to protect customers from financial fraud.

Guardinex

Guardinex, an artificial intelligence fraud prevention startup, secured $5 million for its Series A funding round.

Cable

Cable has raised $5.3m in seed funding, to help them towards reducing financial crime in the world. The round was led by CRV and LocalGlobe, with participation from Anthemis, and a number of highly respected angel investors and industry experts.

OCR Labs

OCR Labs, a Leading Technology Provider of Digital Identity Verification globally, secured $30 Million in Series B funding investment led by New York-based Equable Capital.

OCR Labs’ proprietary technology provides fully automated identity verification through ID document validation combined with facial biometrics.

TransUnion

TransUnion has signed a definitive agreement to acquire Verisk Financial Services, the financial services business unit of Verisk, for $515 million.

Verisk Financial is relied upon by leading financial institutions, payments providers and retailers worldwide for competitive studies, predictive analytics, models and advisory services to provide a clear perspective on where their business stands today — and how to best position them for success in the future.

nSure.ai Ltd, a Israeli predictive artificial intelligence fraud protection startup, has raised $18 million in new investment to allow the company to extend anti-fraud, chargeback-free guarantees and meet growing demand for its services. MoreTech Ventures led the Series A round, with DisruptiveAI, Gryffin Ventures and Moneta Seeds also participating.

Silent Eight

Silent Eight, a pioneer in the field of AI enhanced economic sanctions enforcement and financial crime prevention, has raised $40m in Series B funding round. The round was led by TYH Ventures and welcomed HSBC Ventures, the firm’s latest customer to also become an investor.

Thirdfort

Thirdfort, a London startup, which has built a platform to help professional services firms run more thorough due diligence, and to flag when something is suspicious, has raised £15 million (about $20 million) in Series A funding round. The money will be used to continue expanding its services, specifically to build payment infrastructure directly into its platform. The funding round was led by Breega, with B2B fintech-focused Element Ventures also investing, along with the founders of ComplyAdvantage, Tessian, Fenergo, R3, Funding Circle and Fidel.

Mitek, a global leader in digital identity verification and fraud prevention, today announced the acquisition of UK’s leading KYC technology pioneers, HooYu. The acquisition helps to ensure businesses know the true identity of their customers by linking biometric verification with real-time bureau and sanction database checks.

Verisk

Verisk, a leading global data analytics provider, announced today it has acquired Infutor, a leading provider of identity resolution and consumer intelligence data. The acquisition further enhances Verisk’s marketing solutions offerings to companies across several industries including the insurance industry.

ThreatBlockr

ThreatBlockr, the autonomous cyber intelligence and active threat defense platform, has raised $5 million in funding. This investment round was led by Gula Tech Adventures, Tenfore Holdings, Saul Holdings and Lord Baltimore Capital Partners. The round also included other existing and new investors. ThreatBlockr will be using the latest round of funding to continue growing the team and expanding the platform.

SentinelOne

SentinelOne has acquired Attivo Networks in a $616.5 million deal to bring identity-based threat protection to its extended detection and response (XDR) platform.

SentiLink, the leader in identity verification technology, has acquired Upstream Logix, an industry leader in data intelligence for alternative finance, it’s now part of SentiLink and brings with it powerful insights on underserved consumers and the creditors that serve their financial needs, facilitating accurate risk assessment and enabling consumers to gain access to credit.

| Tagged with: |

| Posted in: | AF Education |