Investment, Acquisitions & IPO’s – Q4 2024

Q4 has wrapped up! It’s time for our quarterly investment update. Explore the latest funding rounds and acquisitions in the world of fraud and risk mitigation!

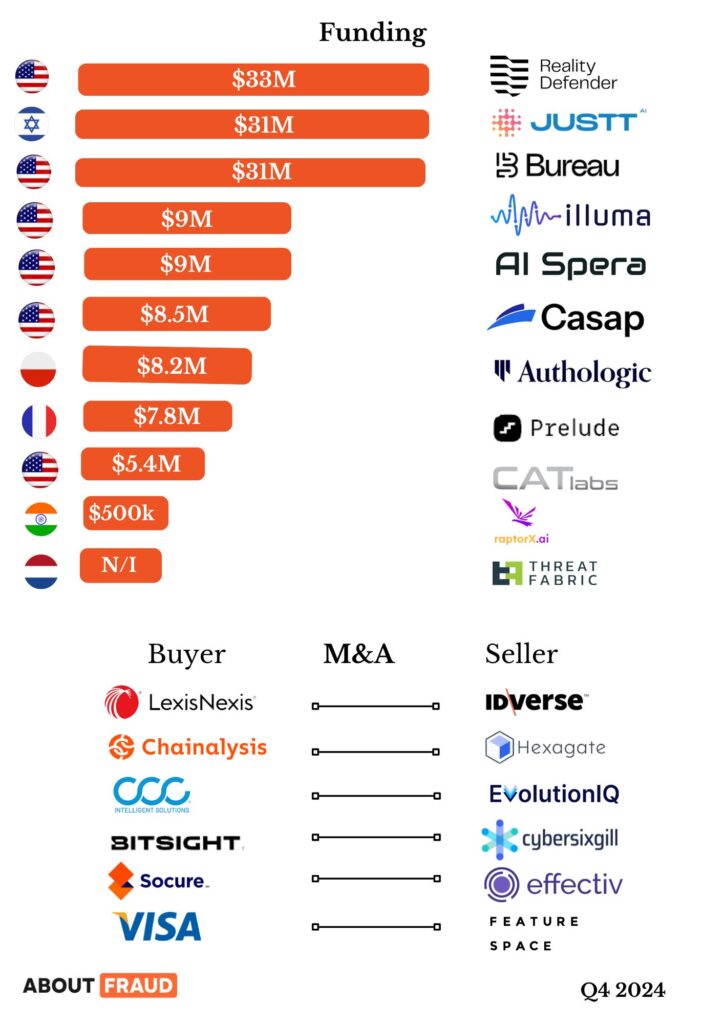

Funding

Reality Defender

The expanded Series A financing came from Illuminate Financial, Booz Allen Ventures, IBM Ventures, the Jeffries Family Office, Accenture, DCVC, and The Partnership Fund for New York City.

Reality Defender is developing technology to tackle enterprise issues related to synthetic media manipulation, which poses risks and costs to organizations through fraud, misinformation, and identity spoofing.

Justt

Justt, a chargeback management fintech based in Tel Aviv, has raised $30M in Series C funding led by Zeev Ventures, with ongoing support from F2 Venture Capital and Oak HC/FT. This latest round brings Justt’s total funding to $100M. Since its launch in 2020, its suite of solutions has served various industries, including e-commerce, crypto, and SaaS. The company plans to use the funds for strategic expansion into high-growth regions like LATAM and APAC, while enhancing its proprietary AI-driven platform.

Bureau

As sophisticated fraud attacks surge, demand for AI-powered prevention is driving significant growth. Bureau, a leading risk intelligence platform, announced $30M in Series B funding to address this challenge, with its revenue tripling since the last fundraising round. With global losses reaching $486B annually, Bureau is equipping businesses with AI tools to combat the escalating threat of advanced fraud.

Illuma

Illuma Labs, a fintech company based in Plano that specializes in advanced voice authentication technology for banking contact centers, has announced the successful securing of $9 million in Series A funding. The funding round was led by LiveOak Ventures, with participation from Forefront Venture Partners, Curql Fund, UsNet, Capital Factory, Connexus, and TDECU.

The company’s flagship product, Illuma Shield, provides contact centers with “frictionless” authentication through the use of passive voice biometrics.

AI Spera

AI SPERA, a South Korean AI-powered cybersecurity company, has announced the successful completion of its latest funding round, raising approximately $9 million and bringing its total funding to $175 million. This round was led by KB Investment, with participation from JB Investment, Kyobo Life Insurance, and Smilegate Investment.

AI SPERA’s flagship product, Criminal IP, is a pioneer in the Security-as-a-Service (SECaaS) model in South Korea, drawing inspiration from global cybersecurity leaders like Google Mandiant and Recorded Future.

This funding will further bolster AI SPERA’s mission to enhance cybersecurity measures and expand its innovative offerings in a rapidly evolving threat landscape.

Casap

Casap is excited to announce the launch of its innovative platform and the successful raising of $8.5M in funding. This includes a $7M seed round led by Lightspeed and a $1.5M pre-seed round by Primary Venture Partners, aimed at transforming the future of payment operations.

Casap is committed to enabling financial institutions—including scaling fintech platforms, innovative credit unions, and forward-thinking banks—to deliver unique consumer experiences and optimize back-office operations at a fraction of today’s cost.

Authologic

Authologic, a leading global digital identity verification platform, has announced a successful $8.2 million Series A funding round. The company specializes in streamlining KYC and AML processes through robust and secure e-ID solutions.

Authologic tackles a significant weakness in traditional KYC systems, which depend on document images for digital identity verification. With the rise of AI-generated fake documents, these methods have become increasingly susceptible to fraud, identity theft, and compliance issues. As a result, businesses can no longer rely on outdated systems for secure identity verification.

Prelude

Prelude, a Paris-based startup specializing in fraud-resistant SMS verification solutions, has raised €7.6 million in seed funding. Led by Singular and Seedcamp, this investment will facilitate Prelude’s expansion across Europe and North America and enhance its platform to provide mobile-first onboarding services.

Catlabs

CAT Labs, a Miami-based company developing tools to combat the misuse of emerging technologies like crypto and AI, has raised $5.4 million in seed funding. The round was led by M13, with participation from existing pre-seed investors Castle Island Ventures, CMT Digital, and Hash3. The company plans to use the funds to expand its business reach.

RaptorX

RaptorX, a fraud prevention software startup, has secured ₹4 crore in pre-seed funding from investors including PeakXV Spark, EagleWings Ventures, and Point One Capital. Notable backers such as Peyush Bansal (Founder & CEO of Lenskart) and Aman Gupta (Co-founder & CMO of Boat), along with senior executives from Google, also participated. The funding will be used to enhance RaptorX’s AI and machine learning capabilities, expand its team, and improve integrations with banking and e-commerce systems. The company aims to address evolving financial crimes with predictive and real-time fraud detection solutions.

Threat Fabric

ThreatFabric, a cybersecurity company based in Amsterdam, Netherlands, renowned for its expertise in detecting and preventing banking threats, has successfully secured additional funding.

This investment was made by Rabo Investments as part of an extension to its 2023 seed round, though the specific amount remains undisclosed.

ThreatFabric’s new funding will further empower its mission to safeguard financial institutions against evolving cyber threats, reinforcing its position as a leader in the cybersecurity landscape.

Acquisition

LexisNexis

LexisNexis® Risk Solutions, a division of RELX, has announced its agreement to acquire IDVerse™, a leading provider of AI-powered automated document authentication and fraud detection solutions. Following the acquisition, IDVerse will be integrated into LexisNexis Risk Solutions Business Services.

Founded in Australia and commercially launched in 2018, IDVerse leverages advanced AI technology to combat fraud and deepfakes. Its proprietary system utilizes a deep neural network to verify the authenticity of identity documents. With consumer consent, it matches a consumer’s face to the image on the document, employing biometric algorithms for identity verification and liveness detection to identify fraudulent submissions.

Chainalysis

Chainalysis, an on-chain analytics company, has announced its acquisition of the Web3 security firm Hexagate.

In a statement on January 19th, as reported by Decrypt, Chainalysis CEO Jonathan Levin shared on X (formerly Twitter), “This acquisition enables Chainalysis and Hexagate to deliver comprehensive risk solutions encompassing blockchain security, compliance, and recovery.”

CCC

Intelligent Solutions Inc. (NASDAQ: CCCS), a leading cloud platform provider for the property and casualty (P&C) insurance sector, has entered into a definitive agreement to acquire EvolutionIQ Inc., a leading platform for AI-driven guidance in disability and injury claims management. Valued at $730 million, the transaction is anticipated to close in Q1 2025, pending standard closing conditions.

This acquisition will broaden CCC’s market reach and enhance its AI-powered SaaS offerings by integrating EvolutionIQ’s transformative capabilities for insurance claims resolution. By incorporating this technology, CCC aims to strengthen its position in the P&C insurance economy and adjacent markets.

Bitsight

The cybersecurity sector is seeing further consolidation as Bitsight, a startup valued at $2.4 billion following Moody’s investment in 2021, announces its acquisition of Cybersixgill for $115 million.

Boston-based Bitsight specializes in cyber risk management, assisting enterprises in assessing their risk profiles and the likelihood of breaches. This involves evaluating a company’s attack surface across its network and digital assets, as well as the effectiveness of its defensive products.

Socure

Socure has acquired Effectiv, now part of Socure, for $136 million in a strategic move to enhance our offerings.

This acquisition strategically combines Socure’s top-tier digital identity verification and fraud solutions with a developer-friendly AI orchestration, model development, and real-time decisioning platform. This unique technology blend, unmatched by any single competitor, will revolutionize how the market addresses fraud, money laundering, and risk throughout the entire customer journey.

Visa

Visa has signed a definitive agreement to acquire Featurespace, a leading developer of real-time AI payments protection technology designed to prevent and mitigate payments fraud and financial crime risks. This acquisition will enhance Visa’s portfolio of fraud detection and risk-scoring solutions used globally by clients to grow and safeguard their businesses.

Originating from Cambridge University’s engineering department, Featurespace has pioneered algorithmic-based solutions that analyze transaction data to detect even the most elusive fraud cases.

| Posted in: | AF Education |