AF Education

Gig Economy Fraud: The Hidden Threat of the 2020 Holiday Season

The end of the year is always a particularly busy and often stressful period for fraud fighters, and this year that’s more pronounced than ever. The 2020 holiday season presents fraud prevention teams with a lot of additional challenges on top of those that are usually present at this time. There are...

Preventing Fraud with Real-Time Data Sources

Reviewing a digital order with limited data, is like reviewing a partial signature for potential forgeries. For example: choose the true partial signature of John Hancock with the limited information provided below. When determining a true signature, one must know the true signature or form of writing to be able to distinguish...

Fraud-Fighter 2.0: Looking for the Next Big Fraud Prevention Startup

One of the reasons we started About-Fraud was to make sense of the many different fraud solutions emerging in the market. In that spirit, we're delighted to launch our inaugural "Fraud Fighter 2.0" program. The program is designed to raise awareness for small, burgeoning Start-ups in the fraud prevention space. We want...

How to Secure Business from Account Takeover Fraud

The massive security breach in Twitter forced businesses and individuals to review their account takeover prevention methods and security measures. On Wednesday, July 15, about 130 of verified Twitter accounts were hacked and were further used in the cryptocurrency-related scam scheme. An early investigation showed the presence of social engineering fraud attack on...

Fraud Solution Provider Infographic

It's one of the most challenging tasks out there. Organizing and grouping the top Fraud Solution Providers on one page... and yet we took our crack at it! Below you will find all the Fraud Solution Providers currently on the About-Fraud Platform, along with some high level categorizations. Click the image to...

What Can We Learn from UK Finance’s Latest Fraud Report?

UK Finance recently released its "Fraud - the Facts 2020" report, which details the latest fraud statistics from the UK banking industry, including categorised insights into the overall amount of UK banking fraud losses. This report is very useful when trying to understand the real impact of fraud to consumers, businesses and...

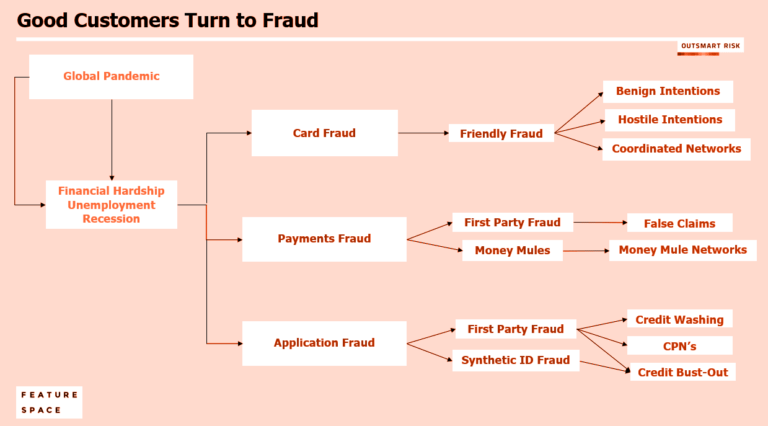

When Good Customers Turn to Fraud

It seems pretty straightforward… there are people who don't commit fraud - your good customers - and people who commit fraud - the ones you set your systems up to detect. However, if you work in fraud prevention you know that line often becomes quite blurred. First party fraud is very common,...

2020 Priorities: Pre-Authorization Risk Screening, CCPA & More!

The record number of data breaches in 2019 serves as a great reminder of why new advances in digital identity verification (DIDV) are increasingly critical. However, I didn’t close out the year thinking about the exceptionally high occurrence in data breach rates. Instead, I chose to focus on the hard-won battles businesses have fought...

Fraud Screening for Retailers: Prepare for Volume Spikes

Retailers spend all year getting their product selection, inventory, logistics and marketing ready for year-end peak sales seasons, but they often don’t adjust their fraud screening tools for sales peaks. Surprisingly, this oversight may not lead to more fraud but to more false declines. Why would otherwise dependable fraud screening rules and...

Intro to Synthetic ID's From a Former FBI Fraud Fighter

Basics & Background In layman’s terms, a synthetic ID is created when a fraudster takes a real or fake social security number (SSN), builds a completely false persona around it (including credit tradelines, ID cards, the works), and uses the fake persona to obtain credit and cash, then disappears… leaving the financial...