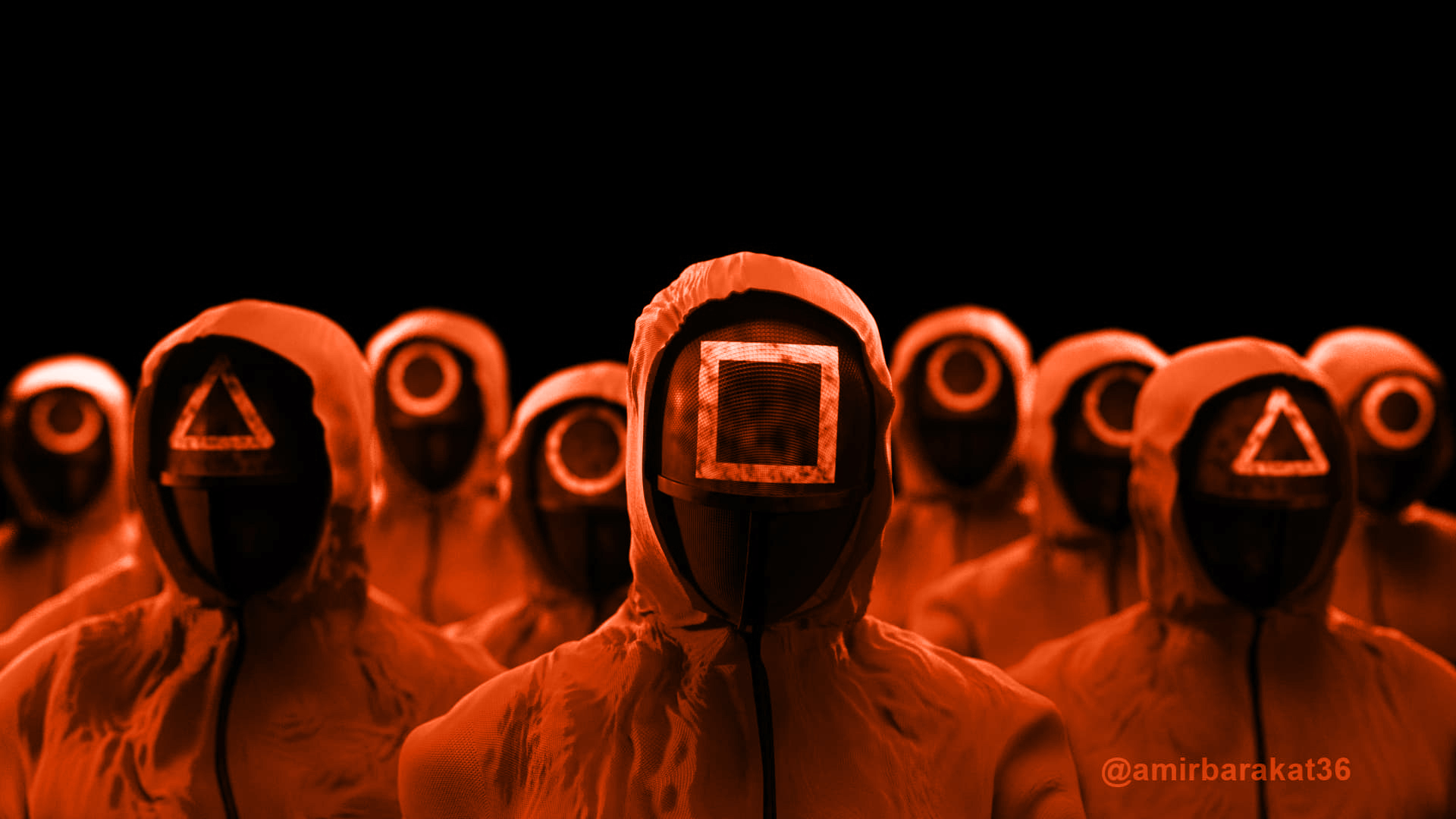

BNPL Games

Squid Game captivated audiences across the globe in September of 2021. Let’s set aside the graphic violence, the premise of economic inequality and crippling debt rings true. And there are more ways than ever to slip down the slope of financial hardship. BNPL is simply the latest and the concerns are legitimate. Let’s stretch this analogy a bit further and explore the current state of BNPL.

BNPL, another way to feed the Squid

BNPL has some redeeming value, but in its current form it’s taking advantage of consumers. There needs to be more regulation for payment methods that operate in a similar manner to loans and credit cards. BNPL companies are permitted to perform only a soft credit check, or no credit check at all, which some companies are taking advantage of. Also, they are side stepping regulations that apply to 5 installments or more, by structuring the payments into 4 installments. Finally, there are no standards for disclosures on fees, amounts owed, credit reporting and payments for BNPL companies.

Buyer beware? That’s nice in theory, but it’s the job of a developed society to have controls in place to protect consumers. That’s why we don’t offer credit cards, loans or other lending vehicles without the appropriate regulations and checks in place. Aside from the financial debt BNPL companies could incur, there is a moral obligation not to entrap consumers.

Stuck in the Pandemic, this Card can Help

BNPL was here before the pandemic, but it has reached its meteoric rise smack in the middle of it. And it’s probably not a coincidence that this is when folks were at their most desperate financially and psychologically. Even in a perfect global climate, BNPL has concerning consequences, but slot it in the middle of Global Pandemic and it will result in an even larger disaster. Top line revenue growth should be a large driver for any company, but the long-term consequences of business and consumer health should be strongly considered.

Some folks know the game before it’s played

If you remember, one of the contestants in Squid Game was getting told the games before they played them. Well, with BNPL some folks are cheating as well. These folks are fraudsters who use compromised data to commit BNPL fraud. They make off with the items, leaving the actual person and company holding the bag of debt. Unlike Squib Game, we can’t “intimidate” customers into not going down the fraud route, therefore on top of the massive credit risk you will have loads of fraud. To be fair, this not unique to BNPL, we see this across the board with lending and credit cards, however it’s better understood. The speed at which BNPL has grown is forcing fraud mitigation to catch up.

Stop feeding the Squid

Debt will always be a problem to some degree. The financial levers of society will always be pulled, allowing folks to live, grow, prosper and yes, acquire debt. But that doesn’t mean we just offer whatever levers folks are willing to pull. The U.S. housing market collapsed over a decade ago because we did this. Folks were blinded by profits and corporate growth and tossed our moral (and legal) obligations out the window. BNPL is abiding by the law, but regulations need to catch up. If we don’t, companies and consumers will be sitting on piles of debt and fraud, with the once attractive revenue growth a distant memory.

Just because I am poking holes in BNPL does not mean the consumer is off the hook. Just like with other forms of credit, folks are responsible for their financial health and should enter into these agreements with a keen awareness of what they are getting into. Where this leaves us is a middle ground that provides checks and balances for both sides. Consumer protection along with the right (and need) to offer financial services that can grow companies and benefit consumers.

| Tagged with: |

| Posted in: | AF Education |