How to Save Revenue for E-commerce Businesses

A dollar saved is a dollar earned, This old idiom has never been more relevant than in 2021 when businesses worldwide try to find new growth drivers and cope with supply chain disruptions caused by the COVID-19 pandemic and lockdowns. What is even worse, fraudsters are much better prepared to leverage the existing situation, as they have vast data banks accumulated and can use them to damage law-abiding businesses.

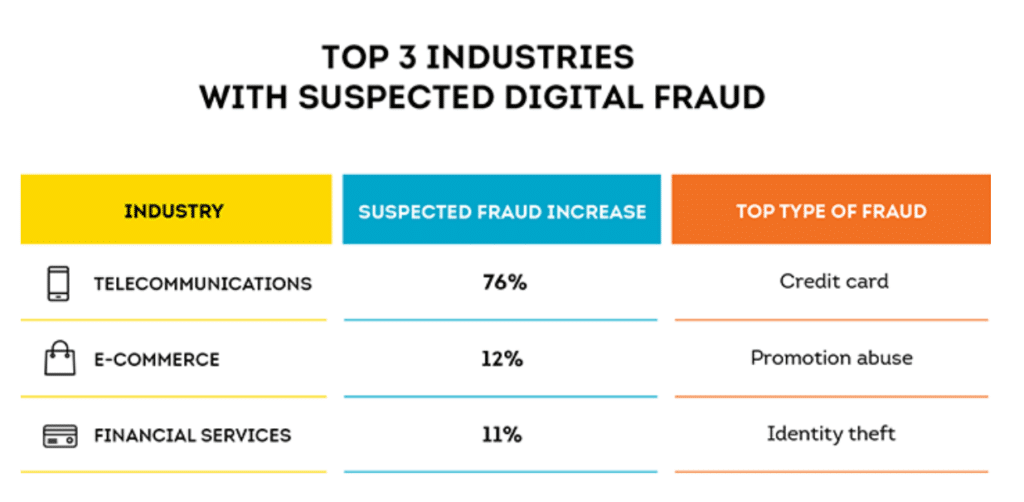

As a matter of fact, telecom, e-commerce and financial services were the top three industries most damaged by fraudsters in 2020. The types of fraud varied from different kinds of card-not-present fraud, affiliate and friendly fraud, to synthetic identity theft, etc.

Source: TransUnion report on Digital Fraud evolution in 2020

How much money was lost to fraud? Well, according to a BusinessWire report, a total sum of fraud losses soared to $56 Billion in 2020, with synthetic identity theft cases accounting for nearly $43 billion of that money. This sum is only going to get bigger, as fraud rings continue to execute new schemes, most of which get unraveled only quite a significant time afterward.

The businesses do not remain idle, though. The best way to combat fraud is by empowering your business software ecosystem with purpose-built risk management solutions to automate customer due diligence checks, risk management, chargeback reduction and prevention of fraudulent activities. Below is a story of one Covery customer, who, almost by pure luck, discovered a fraudulent scheme running at his website, which cost him $56 grand. What’s more, further investigation helped uncover up to $300 grand in losses.

Unraveling a fraudulent scheme using Covery

Thus said, one e-commerce business subscribed to Covery to perform real-time KYC checks and reduce the number of chargebacks through blocking fraudulent transactions. While the former goal was easily achieved and provided value since day one, the latter proved harder to accomplish.

However, when the customer started making use of more advanced Covery features like device fingerprinting (forming a digital profile of a device based on its publicly available software and hardware IDs), he was able to pinpoint a fraudulent ring, which cost him $56,000 due to some affiliates mixing up the traffic.

The warning signs were as follows:

- Multiple payments by different users from a single device within the same affiliate network

- Multiple payments from emulated devices within the same affiliate network

- Similarities between the local and domain parts of email addresses of such users

All of these were already discovered by the risk-logic engine, but adding the device fingerprinting allowed the customer to analyze the problem from another facet. Within the boundaries of several big affiliate networks, there were geographical polygons containing users that performed lots of chargebacks quite often.

The thing initially thought to be a friendly fraud turned out to be a clear case of affiliate fraud. Such bot farms were the key troublemakers and were already reported by other Covery customers. Most likely, these farms contain mobile devices with a multitude of transmitters allowing them to connect to various mobile carrier base stations and disperse the area of activity that way.

However, combining the device fingerprinting, geographical location, and analyzing the previous chargeback history records, Covery was able to identify such bot farms without any mistake. This was done using a feature called “rule forecast report”, which allows applying new rule sets to past transactions. This helps to find previously unseen insights, as well as evaluate the efficiency of every new rule before adding it to the rule-based risk management engine.

When Covery processed the whole base of records of this e-commerce platform, it unraveled five more such schemes executed in the past, with the total sum of losses nearing $300,000. By implementing device fingerprinting and real-time automated KYC, the customer ensured these schemes will not work anymore, saving thousands of dollars of revenue in potential losses. This is one of the many ways Covery can provide value for any business that has to process customer payments online.

Risk management without risk analysts

However, Covery is not only about analyzing the existing records. Due to direct REST API integration with the customer’s CRM and billing systems, Covery enables real-time KYC checking, Anti-Money Laundering protection and regulatory compliance. At the same time, the Device Fingerprinting technology along with the Trustchain global database of 300+ million reputation records help identify PEPs and other culprits on the fly and stop fraudulent transactions before they can harm your business.

Covery is an innovative platform that works with 23 business domains including e-commerce, fintech, gambling, sports betting, dating, and many more. The platform combines the power of AI with configurable rule-based risk logic scenarios 15 are available out-of-the-box and you can add as many as you need. Covery is a certified partner of Dow Jones, one of the world’s leading data custodians and processors.

According to Covery’s product owner, Alexander Khelemskiy, “Covery aims to make risk management process simpler, more transparent and affordable even for businesses that don’t have in-house risk analysts”. Should you want to find out how Covery can help your business — contact them and safeguard your company from fraudsters!

For more in-depth insights on the latest anti-fraud tech trends and innovations, join the Covery webinar on the 29th of May, where industry experts will discuss risk management and anti-fraud protection best practices in 2021.

| Tagged with: |

| Posted in: | AF Education |