Investment, Acquisitions & IPO’s – Q2 2024

The second quarter has concluded! Now, it’s time for our quarterly investment update. Delve into the latest funding rounds and acquisitions in the realm of fraud and risk mitigation!

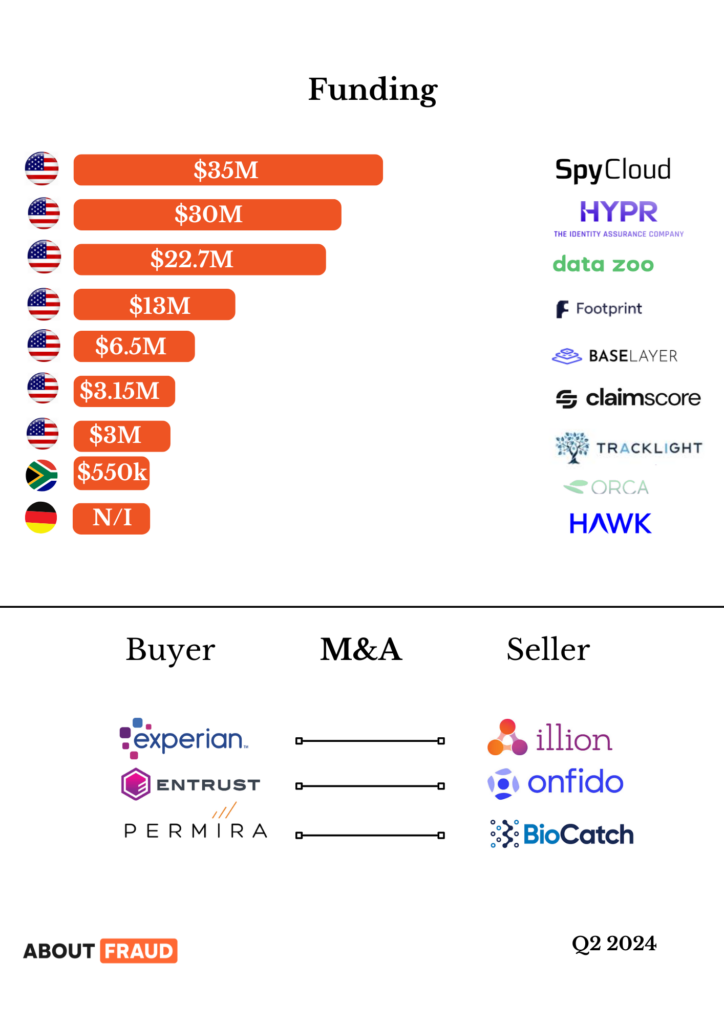

Funding

Spycloud

Texas-based cybersecurity company SpyCloud has secured $35 million in growth financing led by CIBC Innovation Banking. Following a $110 million Series D round in August 2023, this investment will expand SpyCloud’s solutions to help businesses investigate and defend against financial crime.

Hypr

HYPR, the Identity Assurance Company, announced a $30 million investment from Silver Lake Waterman to advance technologies against AI-driven credential-based attacks. This investment supports the growth of HYPR’s passwordless authentication solutions, policy risk, and identity verification products, evidenced by recent large-scale deployments and strategic partnerships.

DataZoo

Data Zoo, a leading global identity verification provider, announced $22.7M (AU$35M) in Series A funding from Ellerston JAADE, an Ellerston Capital fund. This investment will drive the adoption and innovation of Data Zoo’s software, which accesses authoritative data from over 170 countries, improves efficiency with advanced data sequencing, and prioritizes data protection by eliminating identity data storage.

Footprint

Footprint is excited to announce our $13M Series A Round led by QED Investors. Businesses need better onboarding tools to drive revenue and prevent fraud, while people deserve a trustworthy internet.

Baselayer

The banking industry struggles to verify small businesses efficiently in KYB reviews due to manual processes taking days or weeks. Fraud strategies are advancing, costing global banks $500 billion in 2023.

Baselayer in New York is revolutionizing data sharing among financial institutions. It predicts and distinguishes between legitimate and fraudulent patterns, allowing quick verification and risk assessment of new business customers within seconds.

ClaimScore

ClaimScore, a startup using AI to identify fraudulent claims in class action lawsuits, has secured $3.15 million in seed funding led by ROC Venture Group in Naples, Fla.

Established in 2022, ClaimScore is the sole software focused on tackling claims fraud in class action settlements. The company claims to have saved companies $340 million in fraudulent payouts so far.

Tracklight

TrackLight, a leader in AI-powered fraud detection and prevention, has unveiled its cutting-edge platform to combat fraud in government and corporate sectors. The company has achieved a major milestone with a $3 million Seed funding round led by BarronKent and Growth Factory. This investment will expedite TrackLight’s platform development, sales, and marketing.

Orca Fraud

Orca, a South African startup focused on combating various types of fraud in collaboration with banks and fintechs in emerging markets, has secured $550,000 in a pre-seed funding round. This capital will be utilized to develop straightforward yet effective fraud prevention tools and to iterate with customers in South Africa

Hawk

Hawk has expanded its Series B funding round, increasing its valuation significantly. The funds will fuel international expansion and improve AI-driven anti-financial crime solutions. Investors such as Rabo Investments and BlackFin Capital Partners demonstrate strong confidence in Hawk’s technology. Rabo Investments joined existing investors like BlackFin Capital Partners, Sands Capital, DN, Picus, and Coalition in the funding round. The extra capital will be strategically utilized to drive Hawk’s international expansion and address the increasing demand for its AI-driven anti-financial crime solutions.

Acquisition

Experian

Experian, a global information services company, has signed an agreement to acquire illion, a leading credit bureau in Australia and New Zealand.

Founded in 1986, illion provides consumer and commercial credit reporting, as well as identity verification solutions in Australia and New Zealand.

Experian has operated in Australia and New Zealand for over 30 years, offering decisioning software, open data, data quality services, and consumer bureau services. Australia is Experian’s fifth largest market by revenue. The acquisition aligns with Experian’s strategy to focus on scalable markets and drive innovation-led growth.

Entrust

Entrust, a global leader in payments, identities, and data security, has completed its acquisition of Onfido, a top identity verification company. The terms were not disclosed. This acquisition expands Entrust’s AI-powered, identity-centric security solutions.

Nearly two-thirds of data breaches are due to compromised credentials, with AI-powered fraud becoming more common. Onfido reported a 3,000% increase in deepfakes and a fivefold increase in forged identities over the past year. Onfido’s AI technology detects deepfakes, video spoofs, and masks, preventing over $6 billion in potential fraud in the last 18 months.

Permira

BioCatch, a leader in digital fraud detection and financial crime prevention, announced that Permira Growth Opportunities II will acquire a majority position in the company. Existing shareholders Sapphire Ventures and Macquarie Capital will also increase their investments. This transaction aims to accelerate BioCatch’s global expansion, product innovation, and overall growth.

Permira will acquire the majority stake by buying out shares primarily from Bain Capital Tech Opportunities and Maverick Ventures, valuing BioCatch at $1.3 billion.

| Tagged with: | fraud |

| Posted in: | AF Education |