Investment, Acquisitions & IPOs – Q3 2023

Q3 is a wrap! It’s time for our quarterly investment update. Dive in to discover the latest funding and acquisitions in the fraud/risk space!

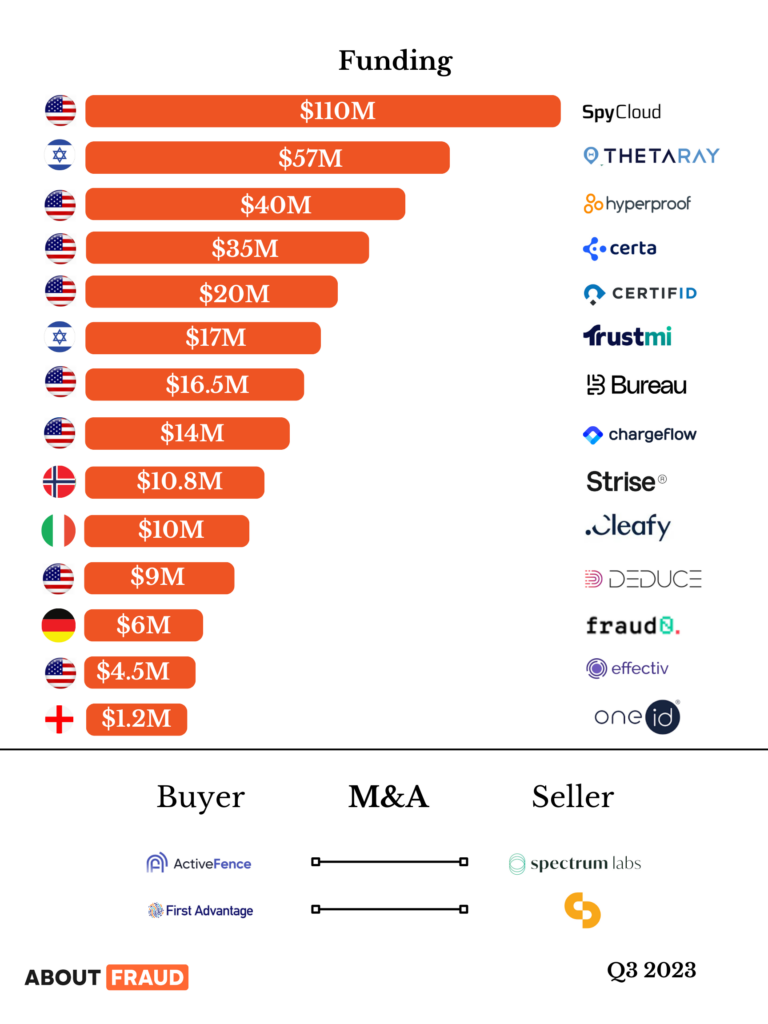

Funding

Spycloud

SpyCloud, a leading identity analytics company specializing in safeguarding digital identities, has successfully closed a $110 million growth round backed by Riverwood Capital, a global investor in high-growth technology firms. Over 500 industry leaders, including half of the Fortune 10, rely on SpyCloud to combat cybercrimes such as ransomware, account takeovers, session hijacking, and online fraud.

Thetaray

Israel-based AI-powered anti-money laundering provider ThetaRay has raised USD 57 million in funding round in order to offer new business opportunities to banks and fintechs.

Following this announcement, the company will use the raise in order to expedite international expansion, as well as to improve its set of services so it meets the needs, preferences, and demands of its customers and of the overall market.

Hyperproof

Hyperproof, a software-as-a-service risk and compliance management company, today announced that it raised $40 million in a funding round led by Riverwood Capital with participation from Toba Capital, an early-stage VC firm.

Certa

Certa, a compliance, governance and risk management platform for enterprises, today announced that it raised $35 million in a Series B round co-led by Fin Capital and Vertex Ventures, with participation from Tru Arrow Partners, Point72 Ventures, BDMI, The Chainsmokers-backed Mantis VC and GOAT Capital.

CertifID

Fraud prevention tech firm CertifID just received a funding boost. The company secured $20 million in a Series B funding round, according to an announcement on Tuesday.

Trustmi

Trustmi lands $17M to scale its payments fraud prevention tech. Shai Gabay and Eli Ben Nun, two entrepreneurs based in Israel, met in 2018 while working at Cynet, a cybersecurity startup developing extended detection and response tools. While there, they came to realize that there was a growing need to secure payment transfers, which were becoming increasingly susceptible to fraud and cybercrime.

Bureau

Bureau is announcing an additional $4.5m from GMO VenturePartners, GMO Payment Gateway, and existing investors to complete its series A funding round at $16.5m. With the completion of the latest round, total funding for the startup has reached $20.5m to date.

Chargeflow

Chargeflow’s mission has always been to simplify and increase profitability for online merchants, retailers, and companies processing online payments. Their ethos has been that businesses should focus on serving their customers, building better products and providing better experiences. They don’t think preventing fraud, fighting chargebacks and dealing with time-consuming and profit-diminishing regulations should be one of the focus points for growing businesses. Chargeflow eliminates those pains and will continue to do so in the future.

Strise

Norwegian AML software firm, Strise, raises $10.8 million in Series A funding. The AI-powered platform offers a 90 percent reduction in diligence time with KYC automation.

Cleafy

Cleafy has announced the latest investment of 10 million euros, the technology company specializing in proactive fraud prevention for digital banking. The funding will allow Cleafy to develop its technology platform further as it expands into new markets.

Deduce

Deduce, the only patented technology platform designed to prevent AI-generated identity fraud, today announced $9M in funding led by Freestyle Capital, with additional investment by Foundry and True Ventures.

Effectiv

Effectiv, a startup specializing in real-time fraud and risk management platforms, shared exciting news about securing an additional $4.5 million in seed funding. This funding will empower organizations in their battle against financial fraud.

Fraud0

Fraud0, a rapidly growing German-based company, has successfully secured a significant investment of €6 million.

One ID

OneID, the exclusive UK provider of bank-verified digital identification services, has just secured a substantial £1 million in fresh funding from ACF Investors.

Founded in 2020, OneID’s mission is to facilitate a secure and seamless digital experience for a broader spectrum of UK citizens. Their approach empowers banks to deliver a reliable ID service for their customers.

Acquisition

ActiveFence

Israeli intelligence start-up ActiveFence has acquired Spectrum Labs, a fellow startup specializing in Contextual AI Content Moderation.

First Advantage

Employment background screening and verification provider First Advantage Corporation has acquired biometric ID verification provider Infinite ID for $41 million in cash from the balance sheet, according to a press release.

| Tagged with: |

| Posted in: | AF Education |