Investment, Acquisitions & IPOs – Q2 2023

Q2 has come to a close, so it’s time for our quarterly investment update. Have a read to learn more about the relevant moves in the industry!

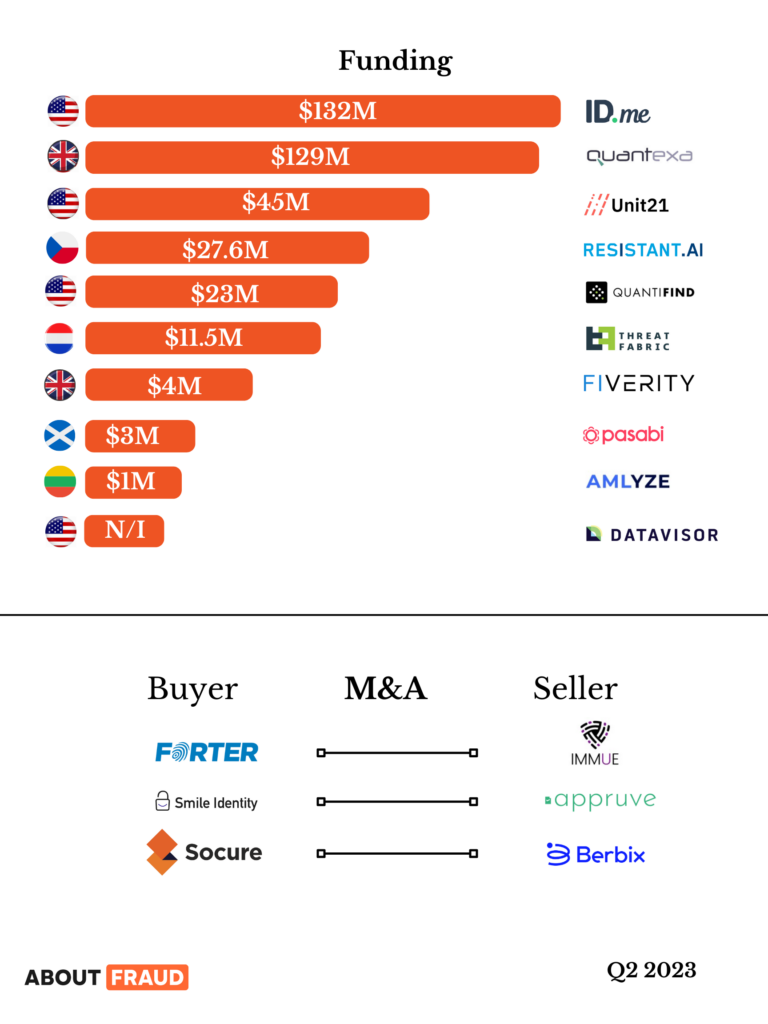

Funding

ID.me

Secure digital identity network ID.me has raised $132m in its Series D funding round and appointed Samantha Greenberg as its new chief financial officer.

The Series D capital injection was led by Viking Global Investors, an American-based hedge fund. Other commitments came from CapitalG, Morgan Stanley Counterpoint, FTV Capital, PSP Growth, Auctus Investment Group, Moonshots Capital, and Scout Ventures.

Quantexa

The UK-based Decision Intelligence (DI) solutions firm Quantexa has announced it has completed a $129 million Series E funding round with a $1.8 billion valuation.

The round was led by GIC and includes Warburg Pincus, Dawn Capital, British Patient Capital, Evolution Equity Partners, HSBC, BNY Mellon, ABN AMRO and AlbionVC.

Unit21

Unit21, the risk and compliance infrastructure company, is excited to share its $45 million Series C funding led by Tiger Global and South Park Commons in 2022. The funding has supported the growth of the Fintech Fraud DAO consortium, which is experiencing a surge in participation and now covers more than 10% of adult consumer transactions in the U.S. Unit21 is also pleased to introduce the first-ever “Fraud Fighters Manual,” a book developed in collaboration with fintech leaders from Brex, Mercury, Lithic, and Treasury Prime that shares insights and lessons to prevent fraud.

Resistant.ai

Resistant AI, an artificial intelligence (AI) and machine learning security company that protects financial services from financial crime, today announced it has expanded its Series A funding to $27.6 million, having raised an additional $11 million investment from Notion Capital. This adds to the existing funding from investors including GV, Index Ventures, Credo Ventures, and Seedcamp.

Quantifind

Quantifind, a provider of AI-powered financial crime risk management solutions, has raised $23 million in a funding round led by DNS Capital.

The round also saw participation from Citi Ventures, US Venture Partners, Valor Equity Partners, and S&P Global.

Founded in 2009 and based in California, USA, Quantifind offers Software-as-a-Service (SaaS) solutions to help banks and financial institutions combat money laundering and fraud. It also partners with government agencies to uncover criminal networks and election tampering.

ThreatFabric

ThreatFabric, a leading provider of fraud detection solutions and intelligence for the financial services sector, has successfully raised €11.5m in a seed round.

The funding round was co-led by ABN AMRO Ventures and Motive Ventures, with participation from 10xFounders and 14Peaks capital.

The Amsterdam-based start-up offers a Fraud Risk Suite, which uses advanced AI models to continuously model threat paths inside online sign-up and payment journeys. With online fraud increasing at an alarming rate, ThreatFabric’s solutions help banks and financial institutions protect their end-users from fraud and malware through a multi-layered approach, including on-device malware detection and behavioural analytics.

Fiverity

FiVerity – the creators of the Anti-Fraud Collaboration platform – announced a $4 million seed financing round led by Mendon Venture Partners – which is a venture capital investment and strategic advisory firm focused on the intersection of financial technology companies and traditional banks. FinCapital, Mendoza Ventures, Service Provider Capital, and Grasshopper Bank also joined Mendon on the cap table. In conjunction with the funding, veteran financial services investor, and former N.Y. Federal Reserve Bank regulator, will join FiVerity’s board of directors.

Pasabi

UK Trust & Safety platform, Pasabi, has secured a multi-million-dollar investment deal to fund the company’s global expansion.

The Edinburgh-based firm, co-founded by entrepreneurs Chris Downie and Martin Spinks, will use the investment to open a series of business hubs in the US, UK, and Portugal as well as hiring specialist staff across key functions of engineering, product development, sales, and marketing. Pasabi will also develop and launch a new version of its product on AWS Marketplace.

Amylize

Lithuania’s Amlyze raises $1 million to help its fight against financial crime.

The anti-financial crime solutions firm will use funding to reach further than the Baltic States as it adds to its solutions for fintechs, neo-banks and crypto businesses.

Datavisor

CMFG Ventures, the venture capital arm of CUNA Mutual Group, has announced a strategic investment in DataVisor, a global firm focused on online fraud detection and risk management for financial services and ecommerce, as they expand their services into the credit union market.

Acquisition

Forter

Forter Acquires Immue to Enhance Bot Detection Capabilities in Wake of Rampant Attacks

Acquisition of Israeli startup will help merchants address surge of bot attacks to improve customer experience and protect the bottom line

Smile Identity

Smile Identity, the African provider of digital identity verification solutions, has acquired Appruve‘s parent company (Inclusive Innovations, Inc.).

This acquisition will enable the startup to expand its footprint across Africa and solidify its position as the continent’s leading identity verification and digital KYC provider.

Socure

Socure, the identity verification service that raised a massive $450 million Series E round at a $4.5 billion valuation during the heady fundraising days of late 2021 (and $100 million earlier in 2021), today announced that it has acquired identity verification service Berbix for $70 million in cash and stock transactions. Berbix previously raised a total of $11.6 million, including a $9 million Series A round led by Mayfield in 2020.

| Tagged with: |

| Posted in: | Uncategorized |