Fraud Prevention in the Customer Experience Era

While FSO’s aspire to prevent fraud losses, focusing on the customer is also critical. Do retail and corporate banking customers expect to experience a certain level of friction to validate the trust that they’ve placed in the FSO?

One argument suggests that if friction is user-friendly, and the customer is able to quickly transition beyond that friction during a legitimate transaction, then many customers accept a certain degree of friction. Some customers want to opt-in and be alerted for every banking transaction, whether that’s a debit payment, wire transfer or ACH. Others only want to be alerted if a transaction is truly suspicious, and FSOs should have the data and analytics tools in place to support customers and their preferred level of fraud defense. On the other hand, some customer segments, depending on their level of digital maturity for example, want less friction because they understand that they can have secure solutions with minimal friction. Given that FSOs are competing with fintechs and third parties that want to introduce transactions through their infrastructure, they need to address the desire for minimal customer friction during authentication while improving security

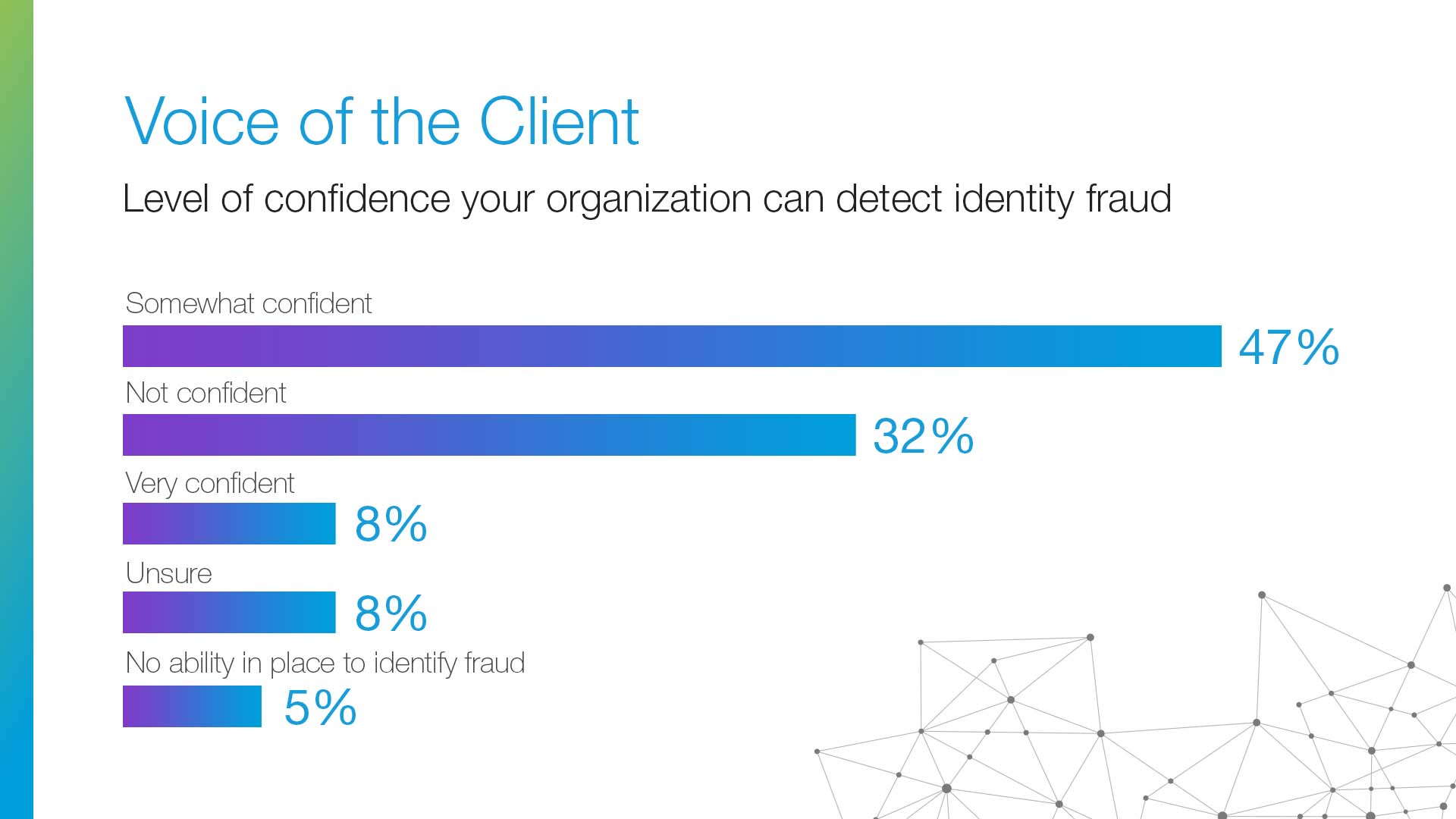

Voice of the Client:

Level of confidence your organization can detect identity fraud

Earlier Fraud Prevention

The industry is shifting their fraud prevention focus toward new clients earlier in the lifecycle to address fraud risk while optimizing the digital experience – either during the account origination process itself or immediately after account origination. With the commoditization of PII on the dark web accelerating synthetic identity fraud, and the demand for near frictionless digital banking experiences, FSOs are under pressure to replace siloed approaches to fraud prevention that are easy for fraudsters to exploit. NICE Actimize’s New Account Fraud provides coverage earlier at the application stage and helps organizations optimize friction levels.

- Advanced analytics connect existing identity verification data and tools to provide a single identity risk score for efficient risk decisioning.

- Seamlessly links application data and identity risk scores into an early fraud monitoring system.

- Accurately detects sophisticated fraud stemming from stolen and

synthetic identities, and mule activity. - Streamlined transition into ongoing monitoring phases, supported by intelligence collected during both the application and early monitoring phases.

- Zero-trust risk profiling fueled by advanced AI to enable intelligent early account access and safeguard against fraudulent accounts at account origination.

Transforming Fraud Prevention into Competitive Differentiation

A lucrative opportunity is available for FSOs to acquire, retain and grow their customers – if they can optimize how they work with customers and deliver a trusted, digital-first experience. But emerging fraud patterns are straining the ability to execute effective fraud prevention while providing safe, enhanced customer experiences. There’s a meaningful generational shift surrounding purchasing power that not only impacts how customers engage with digital banking, but how fraudsters operate. Fraudsters are now adapting their tactics according to different generational personas, which is evident in the fraud schemes and typologies deployed against each generation.

Generational Differences

Each generation interacts, understands and uses technology differently, and fraudsters trigger customers based on this knowledge.

- Gen-Z: This generation is entering into independence and spending their own money, and are typically targeted through chatbots and social media messages.

- Millennials: Targeted via text messages and other automated messages that promise rewards or shipment tracking, and are

vulnerable to phishing attacks. - Gen-X: As the generation between Millennials and Baby Boomers, this generation is often susceptible to the fraud schemes that attack the generations above and below them.

- Baby Boomers: Tend to be targeted through robocalls about healthcare, taxes or social security.

Gen-Z and Millennials are early digital adopters and represent emerging affluent generations. Because they will be experiencing significant life changes in the near future, including buying homes and cars, FSOs are looking to establish early relationships with these customers and provide excellent experiences to attract and retain them. Gen-X and Baby Boomers tend to bank with the future in mind as they’re already settled in life. Unlike younger generations, they’re familiar with standard banking interactions but open to new ideas. For example, a decade ago it was a novelty to hear of grandparents texting their

grandchildren, but this generation has adopted technology and now it’s the norm. Baby Boomers mirror younger generations in their adoption of digital in their interactions, but generally do so at a slower pace.

Earlier Fraud Prevention

FSOs need to adopt a customer-centric approach to fighting fraud according to different generational vulnerabilities.

If customers understand various types of scams then they can better protect themselves. FSOs should take the opportunity to educate customers at every viable point in time so the customer is aware and able to judge for themselves as to what could potentially occur. To grow more meaningful, impactful relationships with their customers and become trusted partners during uncertain circumstances when fraud does occur, organizations should:

- Communicate and be transparent regarding the levels of friction their customers are experiencing with access or transactions.

- Continuously introduce new techniques to educate and improve customer awareness of fraud at critical points in time.

Personalizing Protection by Customer Persona

Customer empowerment must be linked to fraud prevention processes, including enabling customers via digital tools and new interaction channels. This introduces cost optimization, customer stickiness, organizational efficiency, and can result in new opportunities.

- Data and advanced analytics: Data and advanced analytics helps secure the payment methods that newer generations are adopting, and helps organizations protect older generations that might not be familiar with some technologies. It further helps FSOs accelerate their digital-first, mobile-first presence.

- Meaningful friction: Customers expect 24/7, secure access to financial services. FSOs must develop segmented strategies that focus on the specific risk, and add targeted friction without making authentication overly challenging for their customers.

- Deliberate segmentation: Using multiple point solutions and alert systems prevents organizations from gaining a full picture of the customer. Focus on the right segmentation and utilize all available data to deliver a complete customer experience – not just in silos or a single point.

| Tagged with: |

| Posted in: | AF Education |