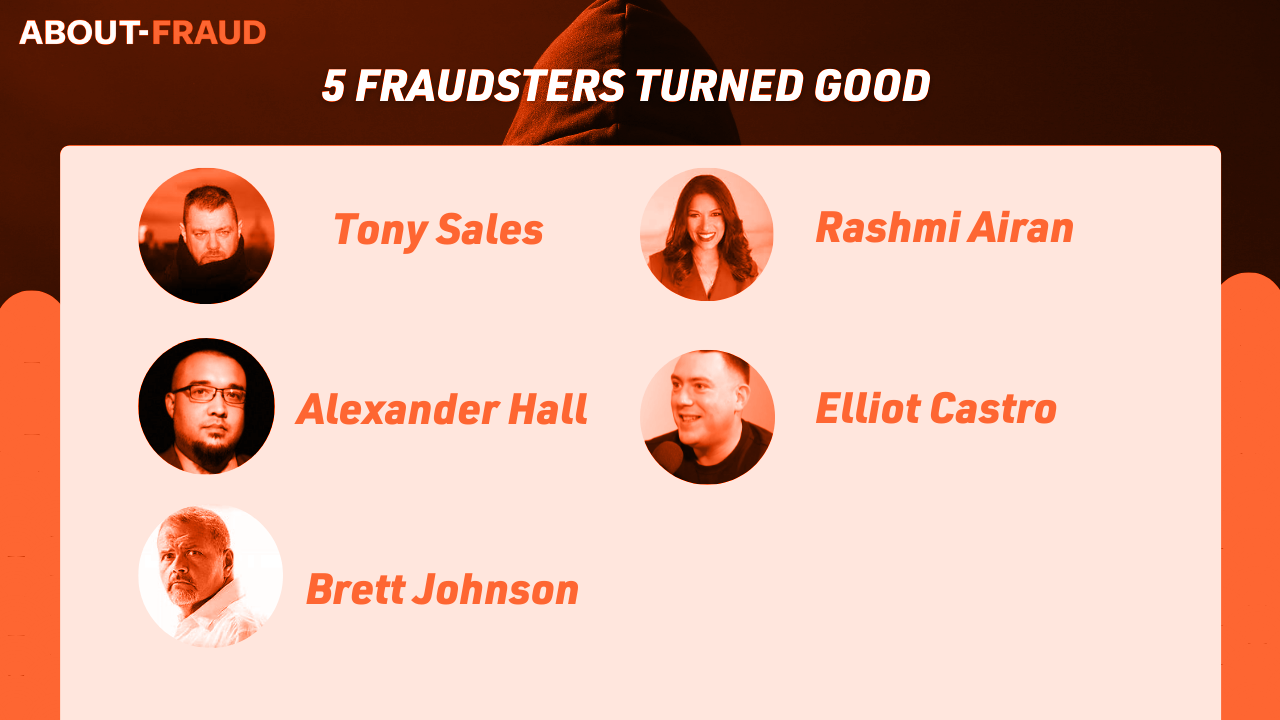

5 Fraudsters Turned Good

The fraud prevention industry has seen a wave of former fraudsters offer their skills and knowledge to the right side of the law, helping stop attacks they used to carry out. It’s a fascinating dynamic, so we decided to provide an overview of some high profile fraudsters turned good. Have a read and link out to learn more about how their lives unfolded and the current work they are doing today.

Tony Sales

Tony Sales is one of very few people to have ever worked at the summits of both organised crime and fraud and loss prevention. Dubbed “Britain’s Greatest Fraudster” by the British media, clearly anyone with such a unique skill set is intrinsically valuable to almost any major organisation. Tony now provides advice to some of the world’s leading brands on their fraud and loss prevention strategies.

The work that Tony undertakes is not just theoretical or academic. His objectives are clear: fraud and other financial crime prevention and opening people’s eyes to what they don’t see. “Don’t for one minute believe it all takes place in the digital world. Human behaviour is notoriously the weakest link – computers don’t commit crime, people do, and only people can prevent it!

Alexander Hall

For nearly a decade, Alexander operated as a fraudster in Las Vegas. The methods that he authored were applied to many aspects of the customer experience journey and across virtually all industries. Leveraging payment information, stolen identity information and a knowledge of system processes, he operated this way until the birth of his daughter. That was the triggering event that him to abandon his old lifestyle and pursue a career that would support and provide for his family. In 2017, Alexander took a position as a fraud prevention manager and proved his ability to create effective fraud prevention strategies that exist outside of the typical checkout form. In 2020, he founded Dispute Defense Consulting and has since collaborated with many service providers and publications to raise awareness and provide actionable insight. At the end of 2021, Alexander has accepted a position on the board of advisors for the University of Nevada – Las Vegas, wherein he advocates for the early development of fraud prevention strategies for business of all industries and sizes.

Brett Johnson

Former United States Most Wanted, Brett Johnson, referred to by the United States Secret Service as “The Original Internet Godfather” has been a central figure in the cybercrime world for over 20 years. He built and was leader of ShadowCrew, the precursor to today’s darknet markets. He was instrumental in developing many areas of online fraud while helping design, implement, and refine modern Identity Theft, Account Take Over Fraud, Card Not Present Fraud, IRS Tax Fraud, and countless other social engineering attacks, breaches, and hacking operations. Upon his capture, the United States Secret Service hired Johnson to work as a consultant and informant. Johnson worked with the Secret Service for several months before going on a cross country crime spree, being placed on the US Most Wanted List, being captured again, sent to prison, escaping prison, being captured yet again, and finally accepting responsibility for his actions.

Today, Brett is Chief Criminal Officer at Arkose Labs and works as a security consultant and public speaker. He is one of the world’s foremost authorities on cybercrime and identity theft. He has been featured in the book, “Kingpin” by Kevin Poulsen and on numerous media outlets, including the New York Times, NBC, CNN Money, Wired Magazine, Vice, ArsTechnica, The Independent, The Lex Fridman Show, and more.

Rashmi Airan

Arian was a former lawyer who graduated with honors from Columbia Law School. After working for several major corporations, she launched an independent law practice in Miami, Florida, During the housing boom, she was recruited to work with a local real-estate developer who later engaged in questionable business practices. She chose not to question her client’s behavior despite her inner voice screaming “ask questions!” Her involvement resulted in a six month sentence to Federal prison for bank, alongside a $19M judgment against future earnings, required community service hours, and 3 years supervised release. While being immensely humbled by this life-changing experience, she emerged with invaluable lessons learned both personally and professionally. Rashmi shares her emotional development of living with remorse, but not letting it define you. She is determined to create a culture of conversation around ethics and compliance and to intergrade ethics into all aspects of our lives. Rashmi continues to tour the country as a public speaker, sharing her story to illustrate the ethical perils that can result from a drive to succeed and the blind spots created when we are pursuing our goals. She speaks on ethics standards of a fiduciary, the consequences for breaching such a duty, the imperatives of an effective compliance program, embedding ethical vigilance into corporate culture, overcoming adversity and more.

Elliot Castro

Ex-fraudster Elliot Castro was working in a mobile phone call centre in Glasgow at the age of 15 when he discovered that it was very easy to take over the credit card accounts of customers, and that he had access to enormous amounts of customers’ personal data – and the power to do what he wanted with the sensitive information.

Clever, and morally blinded by power and greed, Elliot Castro ascended from haircuts and CDs to designer watches worth £12,000 and first class flights. For five years he was chased by detectives and was finally caught in 2004 and sent to prison for two years at the age of 22.

He had spent about £2 million.

With time and scope for soul-searching, Elliot Castro decided to turn his life around when he left prison, and became a highly respected independent fraud prevention consultant. He is dedicated to helping businesses, financial institutions, and law enforcement departments keep their assets secure. His previous clients include Barclays, Metropolitan Police, IATA, UBS, and the FBI.

With a unique insight into the psychology of fraudsters, he can identify the methods they use and crack their opportunistic scams.

| Tagged with: | fraud, fraudster, Woman in Fraud |

| Posted in: | AF Education |